Trading the Adam and Eve pattern involves identifying a specific chart pattern that resembles the shape of an “Adam” followed by an “Eve.” This pattern is typically considered a reversal pattern and can be seen in various financial markets, such as stocks, forex, or cryptocurrencies. Here are some steps to consider when trading the Adam and Eve pattern:

Identify Adam and Eve Pattern:

- Look for a double-bottom pattern on the price chart.

- The “Adam” bottom is a sharp and V-shaped decline.

- The “Eve” bottom follows with a rounded and slower decline.

Trading Strategy Adam and Eve

How to trade the Adam and Eve pattern:

- Long entry: Once the price breaks above the neckline, you can enter a long position.

- Stop-loss: Your stop-loss should be placed below the lowest point of the pattern.

- Profit target: Your profit target should be set at the top of the previous swing high.

Identify the Pattern:

- Look for a double-bottom pattern on the price chart.

- The “Adam” bottom is a sharp and V-shaped decline.

- The “Eve” bottom follows with a rounded and slower decline.

Confirm with Volume:

- Volume can provide confirmation of the pattern. Typically, the volume is higher during the formation of the Adam and lower during the Eve.

- A spike in volume as the price moves from the Eve to the breakout can add validity to the reversal.

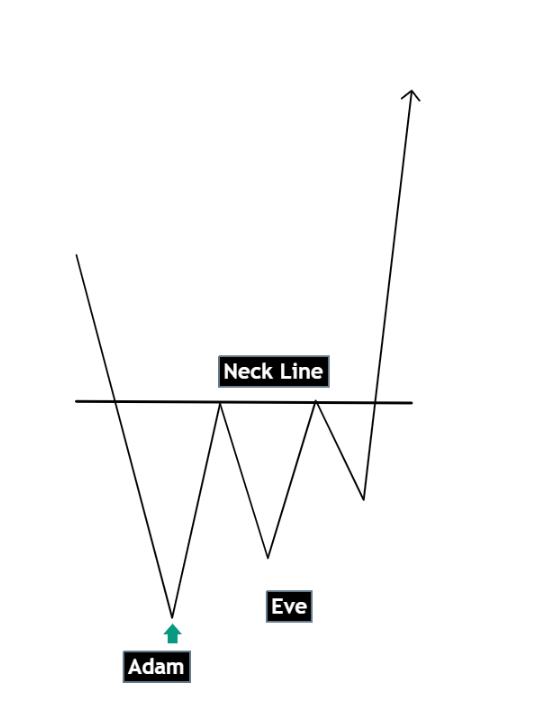

Wait for Confirmation:

- Don’t act solely on the appearance of the pattern. Wait for confirmation, such as a breakout above the neckline.

- The neckline is drawn by connecting the highs between the Adam and Eve bottoms.

Set Entry and Exit Points:

- Enter the trade when the price breaks above the neckline, confirming the pattern.

- Set a stop-loss order below the neckline to manage risk in case the pattern fails.

Bullish Adam and Eve Pattern

Adam and Eve pattern signals a potential bullish reversal. It resembles a double bottom formation, with Adam representing the first bottom and Eve representing the second, slightly higher bottom.

A breakout above the neckline, a horizontal line connecting the two highest points of the Adam and Eve bottoms, confirms the bullish reversal pattern.

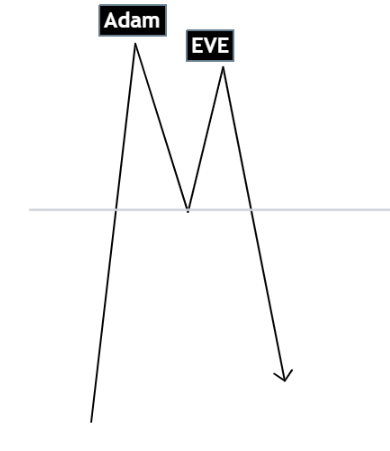

Bearish Adam and Eve Pattern

The Adam and Eve pattern, also known as the double top pattern, can be both bullish and bearish. The pattern is formed when two consecutive tops are formed, with the second top being slightly lower than the first. The pattern is then confirmed when the price breaks below the neckline, which is a line connecting the two lowest points of the two tops.

Bearish Eve and Adam Pattern

In a bearish trend, the Adam and Eve pattern indicates a potential reversal to the downside. The pattern is formed as follows:

Adam: The first top is typically a sharp, V-shaped top.

Eve: The second top is typically a rounder, U-shaped top.

Neckline: The neckline is a line connecting the two lowest points of the two tops.

- Dark Cloud Cover: A Guide to Trading This Bearish Candlestick Pattern - 26 December 2023

- Title: Piercing the Veil of Market Sentiment: The Piercing Pattern in Trading - 26 December 2023

- Bullish Marubozu: A Comprehensive Guide to Trading with Confidence - 26 December 2023