In the world of technical analysis, candlestick patterns serve as the cornerstone for understanding market sentiment and predicting potential price movements.

Among these patterns, the Dark Cloud Cover stands out as a powerful bearish reversal indicator.

This blog post aims to unravel the complexities of the Dark Cloud Cover pattern, explaining its significance, identification, and how traders can effectively incorporate it into their trading strategies.

What is the Dark Cloud Cover Pattern?

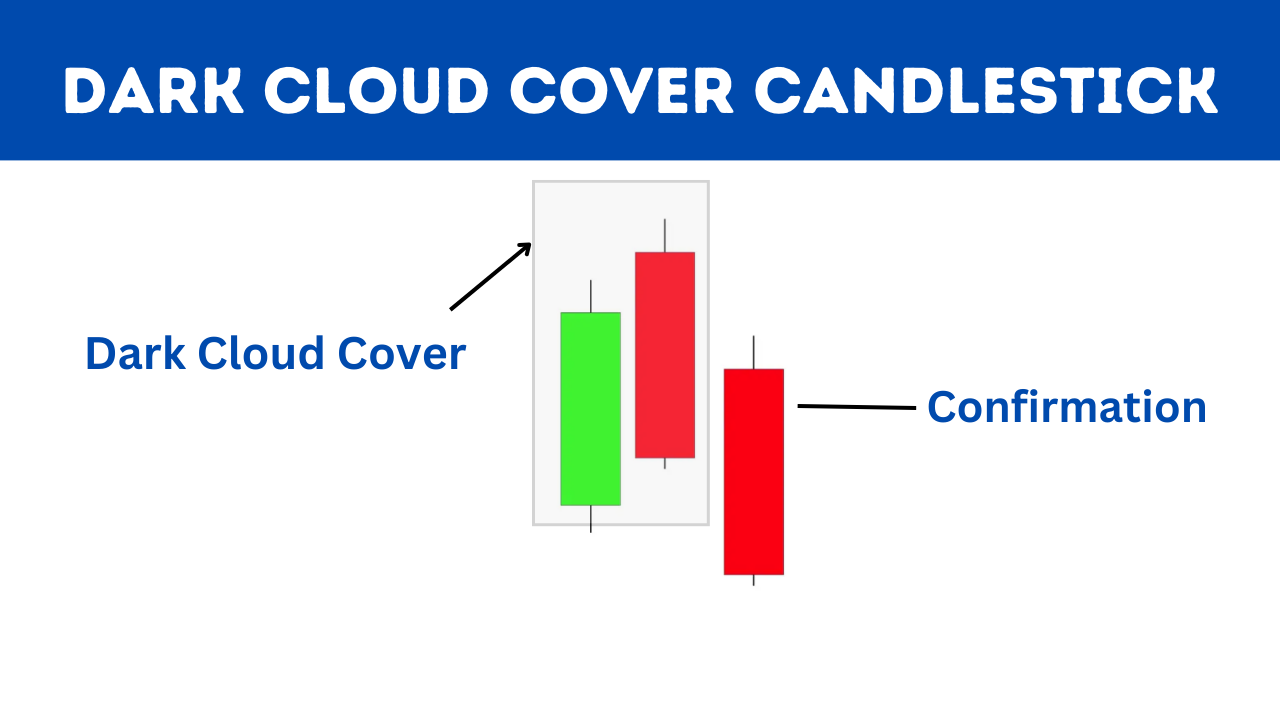

The Dark Cloud Cover is a two-candlestick pattern that often emerges at the peak of an uptrend, signaling a potential shift from bullish to bearish sentiment. This pattern is characterized by a specific formation:

- The First Candle: A large bullish candlestick, which continues the prevailing uptrend.

- The Second Candle: A bearish candle that opens at a new high but closes well into the body of the first candle, typically below the midpoint.

Key Characteristics of the Dark Cloud Cover

- Appearance in Uptrends: This pattern is most significant when it appears after a strong uptrend.

- Bearish Signal: The second candle’s deep penetration into the first candle’s body suggests waning bullish momentum and a growing bearish sentiment.

- Volume Consideration: Higher volume on the second day of the pattern adds to its reliability as a reversal signal.

How to trade dark cloud cover pattern

The trading strategy is simple for this dark cloud pattern.

Identifying the Pattern:

- Focus on uptrends where the first candle is a large bullish one, followed by a bearish candle.

- The bearish candle should open higher than the previous close and close below the midpoint of the first candle’s body.

Entry Points:

- Traders might consider entering short positions or exiting long positions after the confirmation of the Dark Cloud Cover pattern.

- Waiting for additional confirmation, such as a third bearish candle or a break below key support levels, can increase the reliability of the pattern.

Exit Points and Stop-Loss:

- Placing a stop-loss above the high of the Dark Cloud Cover pattern can help manage risk.

- Target exit points could be set based on key support levels or using a predetermined risk-reward ratio.

Risk Management:

- The Dark Cloud Cover should not be used in isolation. Confirm its signals with other technical analysis tools like trendlines, moving averages, and oscillators.

- Always consider the broader market context and news that might influence price movements.

Psychological Insights and Market Implications

The Dark Cloud Cover reflects a shift in market psychology, where initial optimism is overcome by a surge in selling pressure. This change often catches the bullish market participants off guard, leading to a potential trend reversal.

Example of Dark Cloud Cover

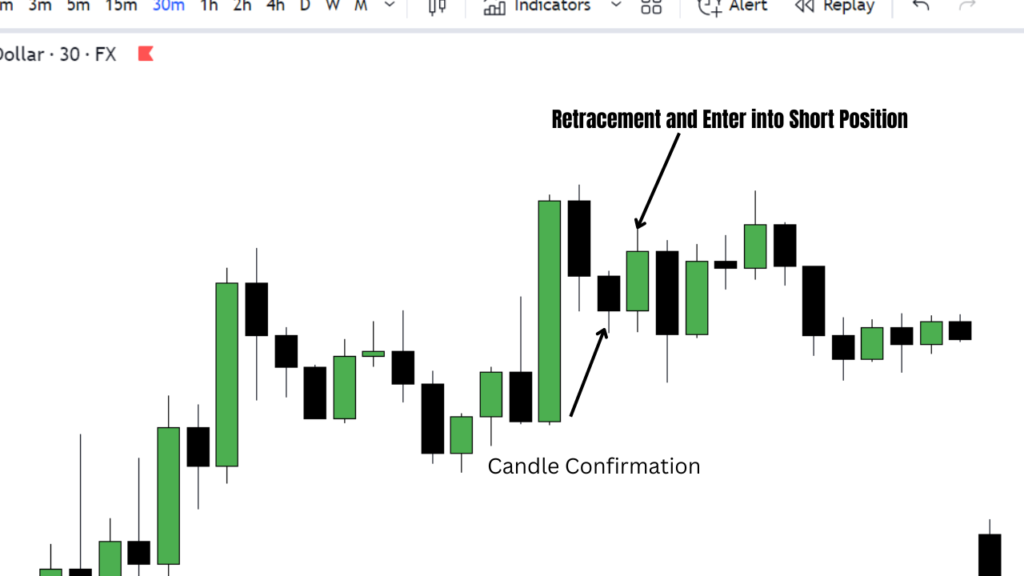

The image below displays a notable Dark Cloud Cover candlestick pattern on the Ethereum/USD (ETH/USD) chart with a 30-minute time frame on December 22, 2023.

It features a pronounced bullish candle, succeeded by a bearish candle. Interestingly, this bearish candle achieves a new high at 2341.74 and closes notably below the midpoint of the prior bullish candle, which is at 2324.02.

The appearance of a third consecutive bearish candle strengthens the bearish signal, suggesting a potential reversal in the upward trend. Therefore, I will wait for a possible retracement before making any trading decisions.

Click here to see the dark cloud on ETHUSD Chart on Trading view

Conclusion

The Dark Cloud Cover pattern is a valuable tool for traders, providing early warnings of potential bearish reversals. By understanding and identifying this pattern, traders can make more informed decisions, enhancing their ability to navigate the markets effectively.

However, it’s crucial to use this pattern in conjunction with a comprehensive trading strategy and sound risk management practices.

Dark cloud cover candlestick pattern strategy pdf download

Click on the below button to download the PDF File

- Dark Cloud Cover: A Guide to Trading This Bearish Candlestick Pattern - 26 December 2023

- Title: Piercing the Veil of Market Sentiment: The Piercing Pattern in Trading - 26 December 2023

- Bullish Marubozu: A Comprehensive Guide to Trading with Confidence - 26 December 2023