Are you looking to enhance your trading strategies? The Drop Base Drop (DBD) pattern might be the tool you need.

In this blog post, we’ll break down the characteristics, entry and exit points, and effective strategies for using the DBD pattern to identify potential trading opportunities.

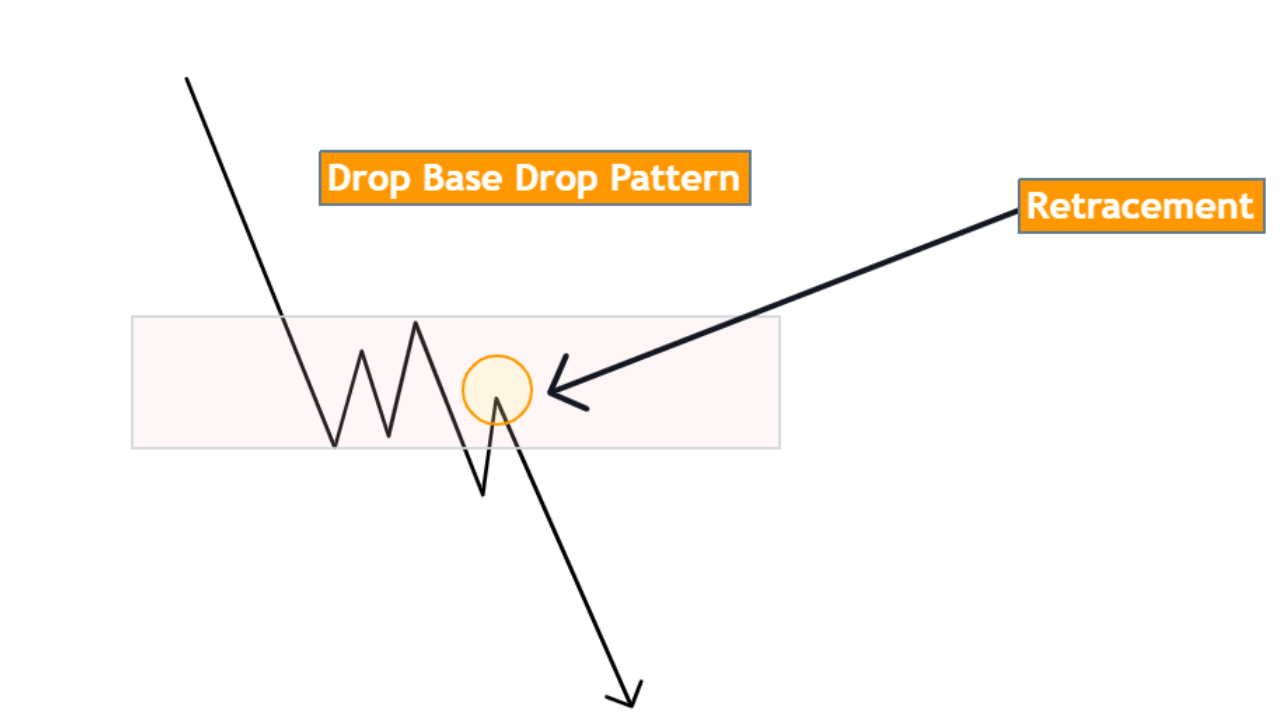

Understanding the Drop Base Drop Pattern:

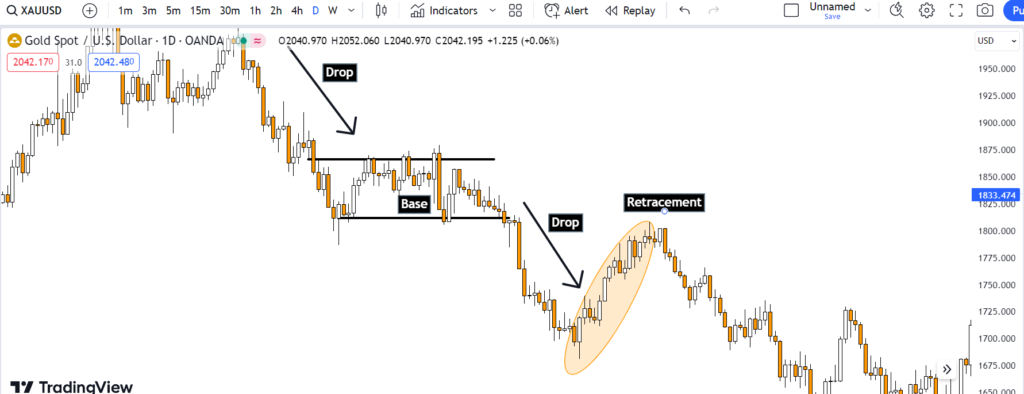

The DBD pattern consists of three waves: the drop, the base, and another drop. The drop marks a sharp decline in prices, followed by a period of sideways consolidation known as the base, and finally, another sharp drop that is typically deeper than the first.

When to Enter and Exit Trades:

- Entry Point: You can enter a sell trade at the low point of the base candle.Or on the retracement

- Exit Point: It’s recommended to exit the trade at the first sign of an uptrend reversal.

Effective Trading Strategies:

- Breakout Strategy: Wait for the price to break above the high of the base candle before entering a sell trade.

- Rally Retracement Strategy: Alternatively, wait for the price to rally back up to the base candle before entering a sell trade.

Managing Risks:

- Stop-Loss: Place a stop-loss order below the low of the base candle to limit potential losses.

- Take Profit: Set a take-profit order at a predetermined level, like the low of the first drop candle.

Key Considerations:

- The DBD pattern is most effective after a strong downtrend.

- Always confirm with other technical indicators.

- Prioritize risk management to safeguard your investments.

Pro Tips:

- Look for the DBD pattern on higher time frames, such as the 4-hour or daily chart, for more reliable signals.

- Use volume analysis to gauge the strength of the pattern.

- Consider incorporating trendlines and Fibonacci retracement levels to identify potential support and resistance.

Conclusion:

The Drop Base Drop pattern is a valuable tool for traders seeking potential opportunities after a significant market downturn. Remember to combine it with other indicators, practice risk management, and consider the broader market context. By incorporating the DBD pattern into your trading strategy, you can make more informed decisions and potentially improve your trading outcomes.

- Dark Cloud Cover: A Guide to Trading This Bearish Candlestick Pattern - 26 December 2023

- Title: Piercing the Veil of Market Sentiment: The Piercing Pattern in Trading - 26 December 2023

- Bullish Marubozu: A Comprehensive Guide to Trading with Confidence - 26 December 2023