In the world of forex trading, recognizing patterns that signal a change in market sentiment is a skill that can elevate your trading game. One such powerful pattern is the Drop Base Rally (DBR), a supply and demand reversal pattern that often marks the transition from bearish to bullish momentum.

Understanding the DBR Pattern

1. Supply and Demand Reversal:

- At its core, DBR signifies a shift in the balance of supply and demand, heralding a potential reversal in the prevailing market trend.

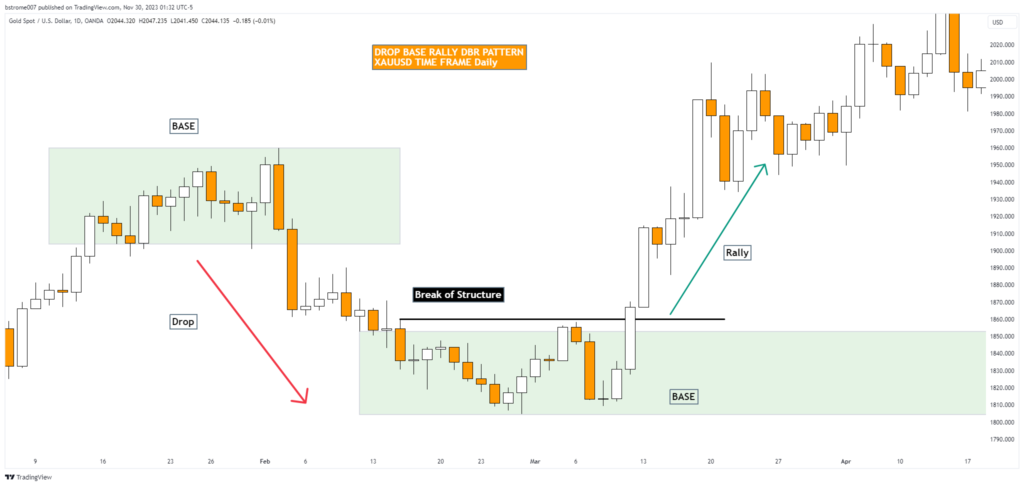

2. Phases of DBR:

- Drop Phase: The journey begins with a sharp price decline, indicating robust selling pressure.

- Base Phase: A period of consolidation or sideways movement forms the base, laying the groundwork for a possible trend reversal.

- Rally Phase: The breakthrough above the base signals a surge in bullish momentum.

Drop Base Rally Example

Confirmation and Entry Strategies

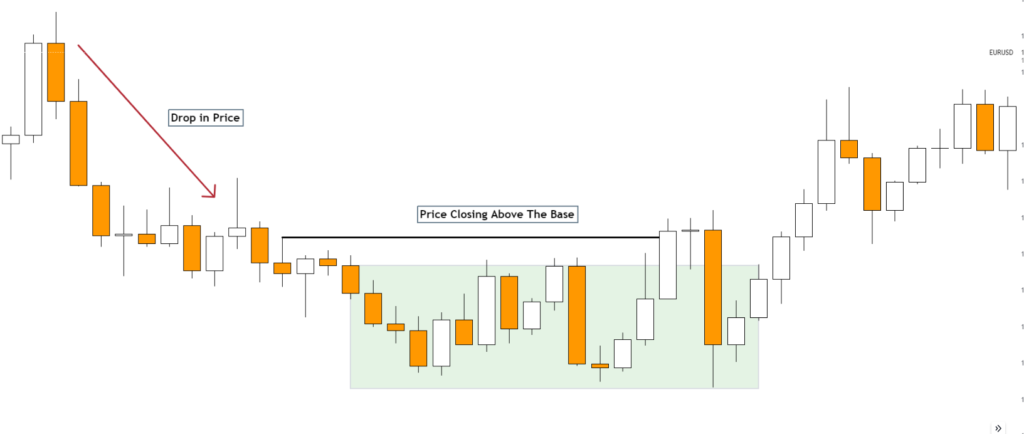

3. Closing Above the Base:

- A key indicator of a potential trend reversal is the closing price rising above the base. This signals the exhaustion of bearish momentum.

4. Long Position Strategies:

- Forex traders can strategically enter the market by initiating a long (buy) position.

- Entry points may include the breakout of the structure, retracement levels, or significant Fibonacci retracement levels.

5. Golden Fib Levels:

- Fibonacci retracement levels, particularly the golden ratio of 61.8%, are often employed as entry points for traders seeking optimal timing.

6. Higher Time Frame Analysis:

- Elevating the analysis to higher time frames provides a more comprehensive view of the market trend and strengthens the reliability of the trade signal.

Crafting a Winning Strategy

Incorporating DBR into your forex trading strategy involves a blend of patience, confirmation, and technical analysis. The key is to wait for the right signals and utilize additional tools like Fibonacci retracement levels and higher time frame analysis to refine your entry points.

By mastering the art of recognizing the DBR pattern, forex traders can position themselves strategically in the market, capitalizing on potential trend reversals. Remember, successful trading is a journey, and the DBR pattern is a valuable compass guiding you through the twists and turns of the forex landscape.

Psychology Behind this Pattern (Drop Base Rally)

- Initiating the Drop:

Imagine strolling through a bustling marketplace when, suddenly, prices take a nosedive – the inception of the drop phase. Why? Savvy investors and institutions, collectively known as smart money, strategically kick off a sell-off. Their aim? To spark panic selling among retail traders and asset holders.

- Creating Panic:

As prices sharply descend, a wave of panic sweeps through shareholders and asset holders, reminiscent of a flash sale triggering impulsive reactions. Why? Smart money capitalizes on the psychological vulnerability of retail traders, deliberately crafting an environment saturated with fear and urgency.

- Releasing Shares at Lows:

Amidst the prevailing panic, smart money tactically begins releasing their shares or assets at lower prices. Why? By leveraging the panic-induced low prices, smart money not only recoups their initial holdings but also accumulates a larger share than before.

- Consolidation – The Base:

Following the drop, prices find stability, forming a crucial base. This phase signifies a pause in the selling momentum. Why? Smart money takes a strategic breather, providing the market an opportunity to settle. Concurrently, retail traders who hastily sold during the panic phase start questioning their decisions.

- Strategic Accumulation:

During the base phase, smart money strategically amasses more assets, gearing up for the subsequent move. Why? The objective is clear – to buy low and secure a substantial position before the anticipated reversal in prices.

- Unleashing the Rally:

The pinnacle arrives as prices break out of the base, surging higher and indicating a robust buying pressure. Why? Smart money, having orchestrated the initial price drop, seizes the opportunity to buy at lower levels. Riding the wave of the ensuing rally, they profit from the rebound in prices.

Learn More about

- Supply and Demand Trading

- Supply and Demand Continuation Pattern(Rally Base Rally)

- Supply and Demand Continuation Pattern (Drop Base Drop)

- Dark Cloud Cover: A Guide to Trading This Bearish Candlestick Pattern - 26 December 2023

- Title: Piercing the Veil of Market Sentiment: The Piercing Pattern in Trading - 26 December 2023

- Bullish Marubozu: A Comprehensive Guide to Trading with Confidence - 26 December 2023