In the dynamic world of trading, candlestick patterns offer valuable insights, acting as visual markers of market sentiment.

Among these patterns, the bullish and bearish engulfing bars stand out as powerful indicators of potential trend reversals. But what exactly differentiates a bullish engulfing bar from a bearish one, and how can you develop effective trading strategies around these patterns?

Let’s dive into the details and explore the nuances of these engulfing patterns.

Understanding Bullish and Bearish Engulfing Bars

Bullish Engulfing Bar

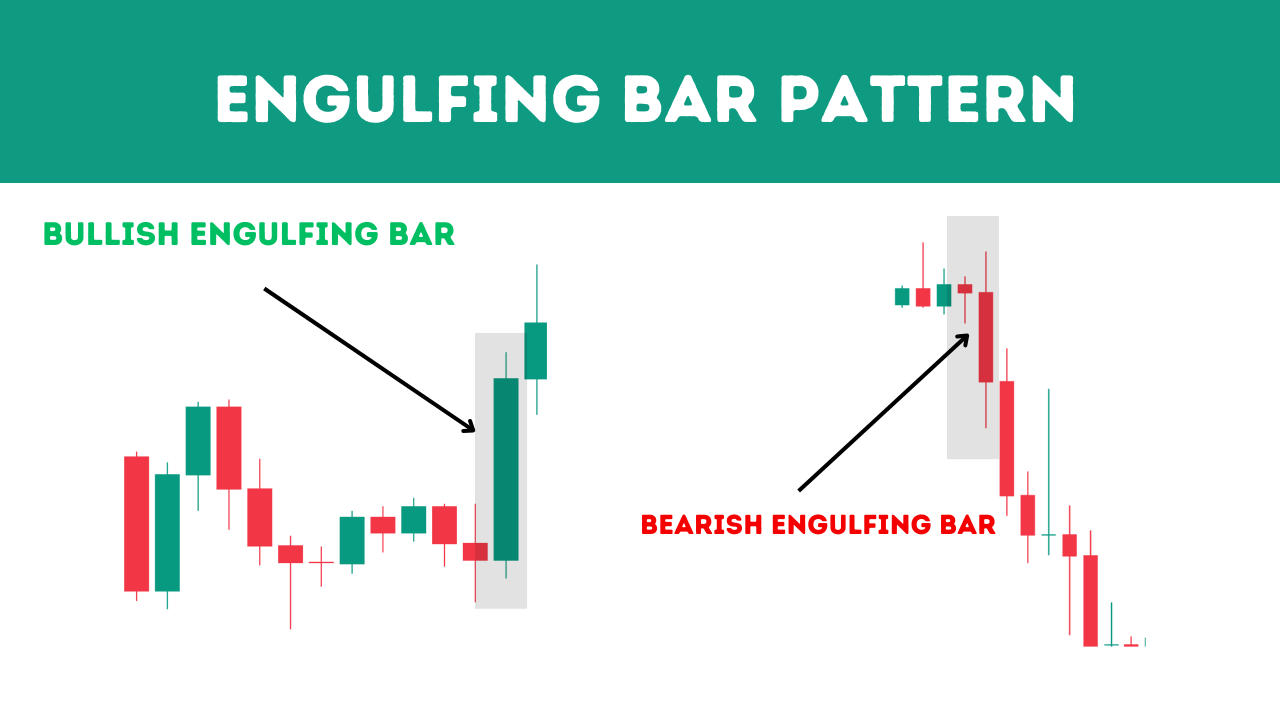

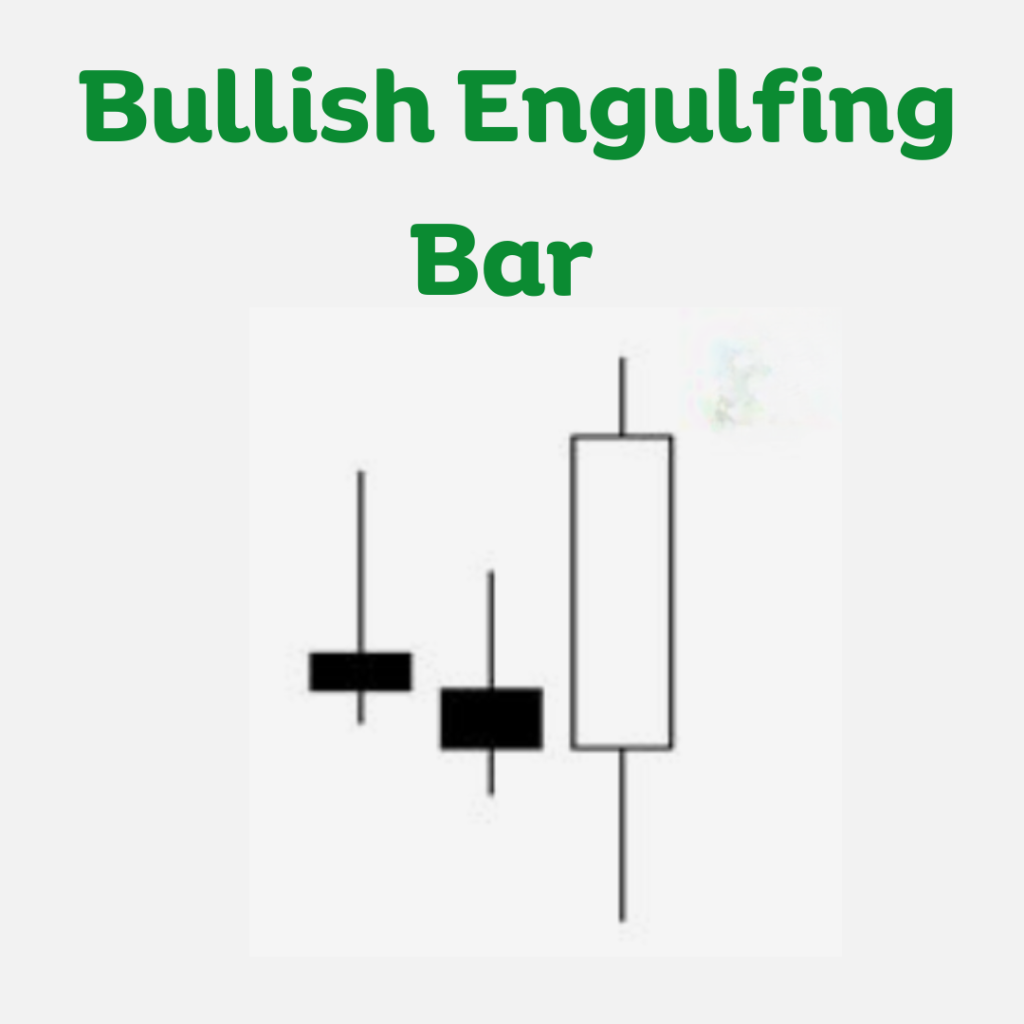

A bullish engulfing bar is a two-candlestick pattern that signals a potential upward trend reversal. It occurs at the end of a downtrend and is characterized by a small, bearish (red or black) candle followed by a larger bullish (green or white) candle that completely ‘engulfs’ the body of the previous candle.

This pattern indicates that buying pressure has overtaken selling pressure, suggesting a shift in market sentiment from bearish to bullish.

Bearish Engulfing Bar

Conversely, a bearish engulfing bar is indicative of a potential downward trend reversal. It appears at the end of an uptrend and features a small bullish candle followed by a larger bearish candle.

The second candle fully engulfs the first candle’s body, signifying that sellers have overwhelmed buyers and a bearish sentiment is taking hold.

Key Differences

The primary difference between these two patterns lies in their formation and implication:

- Trend Preceding the Pattern: Bullish engulfing bars form after a downtrend, while bearish engulfing bars appear after an uptrend.

- Candlestick Colors: The first candle in a bullish engulfing pattern is bearish, followed by a larger bullish candle. In bearish engulfing bars, the first candle is bullish, succeeded by a larger bearish candle.

- Market Implication: Bullish engulfing patterns suggest a potential upward reversal, whereas bearish engulfing patterns hint at a downward reversal.

Trading Strategies

Bullish Engulfing Bar Strategy

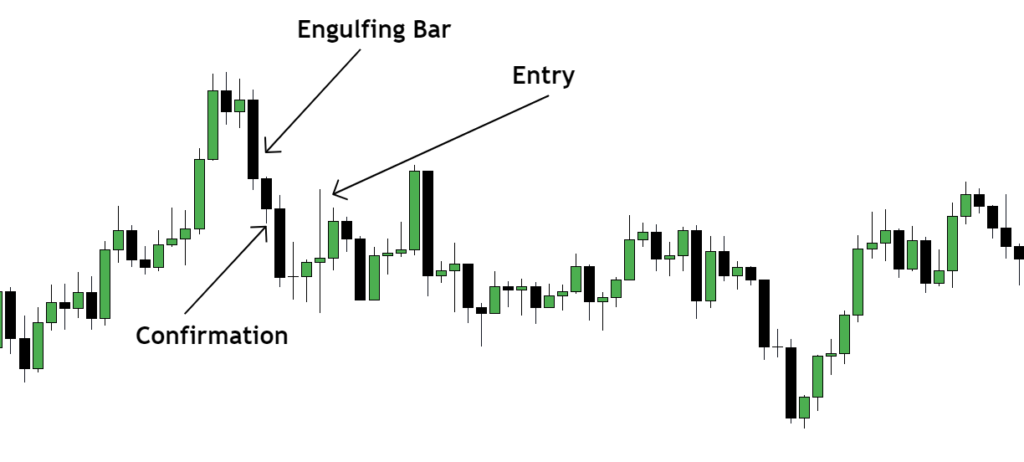

- Identification: Spot a bullish engulfing pattern at the end of a downtrend.

- Confirmation: Wait for additional bullish signals in the next candle or an increase in trading volume.

- Entry Point: Enter a long position after the pattern is confirmed.

- Stop Loss: Set a stop loss below the low of the engulfing bar to minimize risks.

- Take Profit: Target a significant resistance level or use a predetermined risk-reward ratio for taking profits.

Bearish Engulfing Bar Strategy

- Identification: Look for a bearish engulfing pattern at the end of an uptrend.

- Confirmation: Seek further bearish indicators or a spike in volume following the pattern.

- Entry Point: Initiate a short position once the pattern is confirmed.

- Stop Loss: Place a stop loss above the high of the engulfing bar to protect against potential losses.

- Take Profit: Set your take profit at a key support level or based on a specific risk-reward ratio.

Curious about other candlestick patterns and their implications? Explore our comprehensive guides on patterns like the Hammer, Hanging Man, and Shooting Star for more insights into candlestick trading strategies.

Bullish and bearish engulfing bars are powerful tools in a trader’s arsenal, providing early signals of potential trend reversals.

Understanding the differences and similarities between these patterns is crucial for developing effective trading strategies. However, remember that these patterns are most effective when combined with other technical analysis tools and sound risk management practices.

Have you used engulfing bar patterns in your trading? What insights or experiences would you like to share? Let’s discuss this in the comments below and continue our journey towards trading mastery!

- Dark Cloud Cover: A Guide to Trading This Bearish Candlestick Pattern - 26 December 2023

- Title: Piercing the Veil of Market Sentiment: The Piercing Pattern in Trading - 26 December 2023

- Bullish Marubozu: A Comprehensive Guide to Trading with Confidence - 26 December 2023