In the dynamic world of trading, the Evening Star candlestick pattern is a captivating formation that serves as a harbinger of a potential bearish reversal.

This pattern is particularly relevant in the realm of price action trading, where understanding candlestick formations is crucial for informed decision-making. Let’s delve into the intricacies of the Evening Star pattern and how it can be a vital tool for traders.

Learn more about bullish reversal pattern Morning Star

What is the Evening Star Candlestick Pattern?

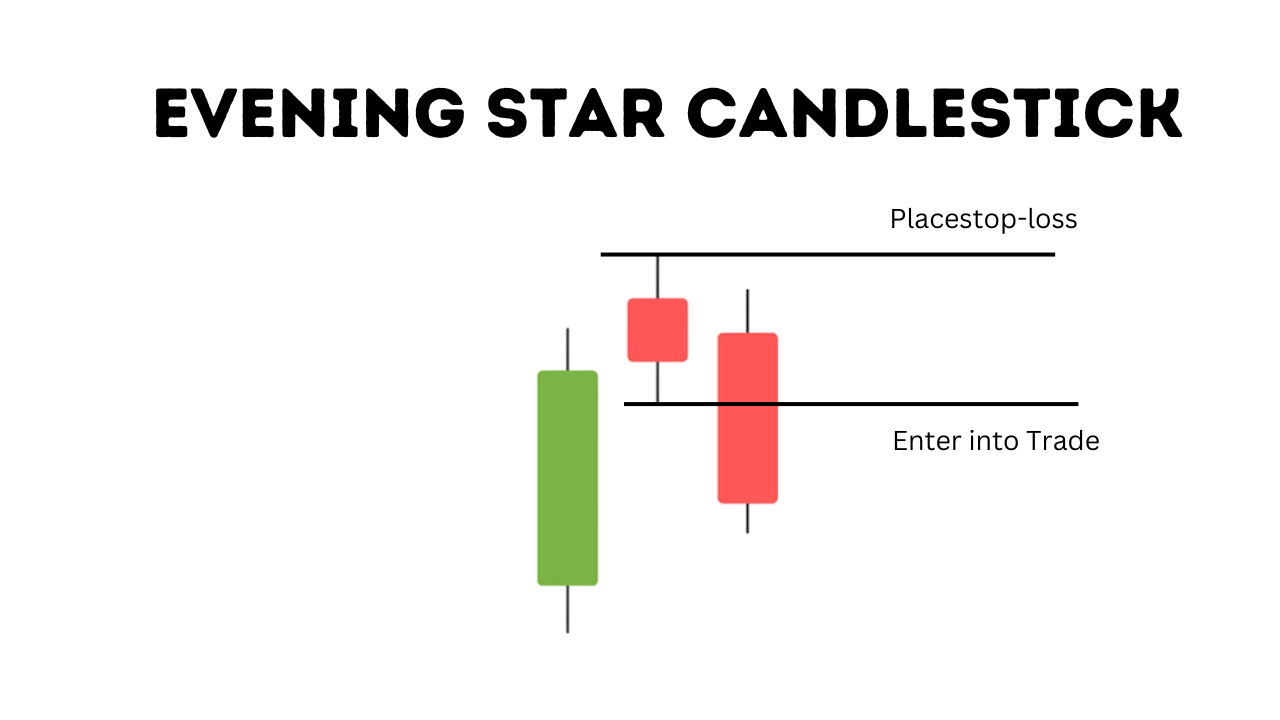

The Evening Star is a bearish candlestick pattern traditionally found at the end of an uptrend, signaling a potential shift in momentum from buyers to sellers. It is a three-candle formation comprising:

- A large bullish candle representing strong buying pressure.

- A small-bodied candle (the star) that gaps above the first candle, reflecting indecision.

- A large bearish candle that closes well into the body of the first candle, indicating a shift towards selling pressure.

This pattern is named for its resemblance to an evening star in the sky, symbolizing the onset of darkness or, in trading terms, a darker period for buyers.

Significance in Trading

The Evening Star pattern is significant for several reasons:

- Reversal Signal: It’s a strong indicator of a potential reversal in an uptrend.

- Market Psychology: It reflects a shift in market sentiment, from bullish to bearish.

- Decision Making: Traders use it to make strategic decisions like exiting long positions or entering short trades.

How to Identify and Interpret

To effectively utilize the Evening Star pattern, traders should:

- Identify the Pattern: Recognize the three key candles in an existing uptrend.

- Observe Volume: Higher volume on the third candle adds credibility to the reversal.

- Consider the Context: The pattern should be analyzed in the context of the prevailing market conditions and other technical indicators.

Trading Strategies Involving the Evening Star

Upon identifying an Evening Star, traders might:

- Exit Long Positions: Close any bullish trades to prevent potential losses.

- Enter Short Positions: Initiate a short trade with a stop loss above the high of the first candle.

- Wait for Confirmation: Before taking action, wait for additional bearish confirmation in the following candles or from other indicators.

Risks and Considerations

While the Evening Star is a powerful tool, it comes with its risks:

- False Signals: Not all Evening Star formations lead to reversals; false signals can occur.

- Market Context: Ignoring the broader market context can lead to misinterpretation.

- Risk Management: Proper stop-loss orders and risk management strategies are essential.

Conclusion

The Evening Star candlestick pattern is a valuable component in the arsenal of any trader, particularly those specializing in price action trading. However, traders should approach this pattern with caution, considering the broader market context and employing sound risk management practices.

Remember, no single pattern can guarantee success, but understanding the Evening Star can significantly enhance your trading strategy.

- Dark Cloud Cover: A Guide to Trading This Bearish Candlestick Pattern - 26 December 2023

- Title: Piercing the Veil of Market Sentiment: The Piercing Pattern in Trading - 26 December 2023

- Bullish Marubozu: A Comprehensive Guide to Trading with Confidence - 26 December 2023