In the world of trading, patterns are like secret codes that savvy traders use to predict market movements. One such pattern is the falling wedge, and in this blog, we’ll unravel its mysteries and explore how traders can use it to their advantage.

Understanding the Falling Wedge Pattern

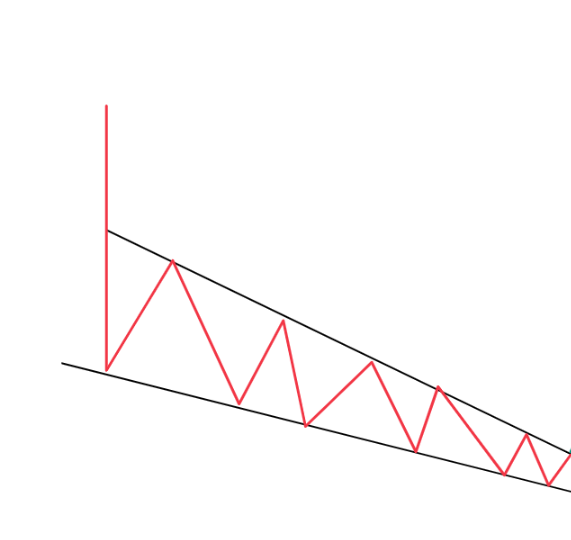

A falling wedge chart pattern is a technical analysis pattern that is considered to be a bullish reversal pattern.

It is formed when the price of an asset moves lower within two converging trendlines, forming a wedge shape. The trendlines converge as the price moves lower, indicating that the downward momentum is slowing down.

This convergence is thought to be a sign that buyers are stepping in and supporting the price, which could lead to a breakout to the upside.

Interpreting the Falling Wedge

Bullish Reversal or Continuation:

- Bullish Continuation: If the price breaks out upwards from the falling wedge, it’s a sign that the previous upward trend might continue.

- Bullish Reversal: When the falling wedge forms after a downtrend, it could indicate a reversal, suggesting the start of an uptrend.

Trading Strategies with the Falling Wedge

1. Patience is Key:

- Wait for the falling wedge pattern to fully form before making any trading decisions. It’s like waiting for the perfect wave before catching it.

2. Confirmation through Breakout:

- Only enter a trade when the price breaks out of the wedge pattern. It’s akin to confirming that the wave is indeed coming.

3. Volume – The Unseen Player:

- Keep an eye on trading volume. A surge in volume during the breakout can add weight to the pattern, acting as a sort of cheer from the crowd.

4. Divergence Signals:

- Look for signals from other indicators like RSI or MACD. Their agreement with the falling wedge pattern strengthens your trading thesis.

Additional Tips for Success

1. Practice Makes Perfect:

- Before risking real money, practice your strategy using historical data or in a simulated trading environment. It’s like rehearsing your moves before the big performance.

2. Keep an Eye on the Clock:

- Consider the timeframe you’re trading in and how the falling wedge fits into the broader market context. Different timeframes can offer different perspectives.

Latest posts by fairvaluegaps.com (see all)

- Dark Cloud Cover: A Guide to Trading This Bearish Candlestick Pattern - 26 December 2023

- Title: Piercing the Veil of Market Sentiment: The Piercing Pattern in Trading - 26 December 2023

- Bullish Marubozu: A Comprehensive Guide to Trading with Confidence - 26 December 2023