The flag pattern is a popular technical analysis tool used by traders to identify potential continuation of a previous trend. This pattern is characterized by a sharp move in one direction (the flagpole) followed by a period of consolidation (the flag) before the price resumes the original trend.

What is Flag Pattern

Flag patterns are technical analysis chart patterns used by traders to identify potential continuation moves in the direction of the prevailing trend.

Component of Flag Pattern

- Flagpole: A sharp and sustained move in one direction, either upwards or downwards.

- Flag: A period of consolidation within a trading range following the flagpole. The flag is often characterized by smaller price movements and resembles a rectangle or a pennant shape.

- Breakout: The point where the price breaks out of the trading range of the flag, confirming the continuation of the trend.

Types of Flag Pattern

There are two primary types of flag patterns:

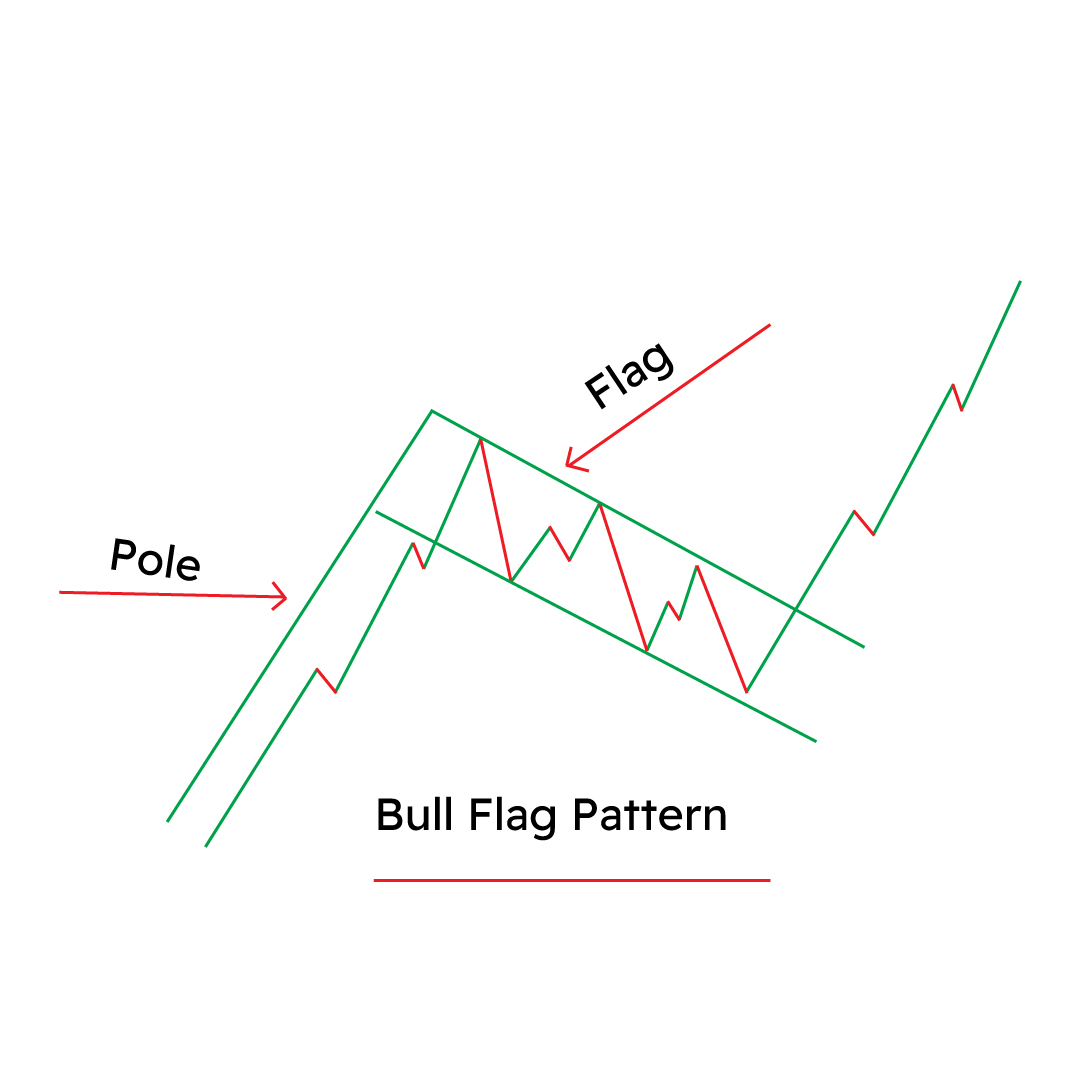

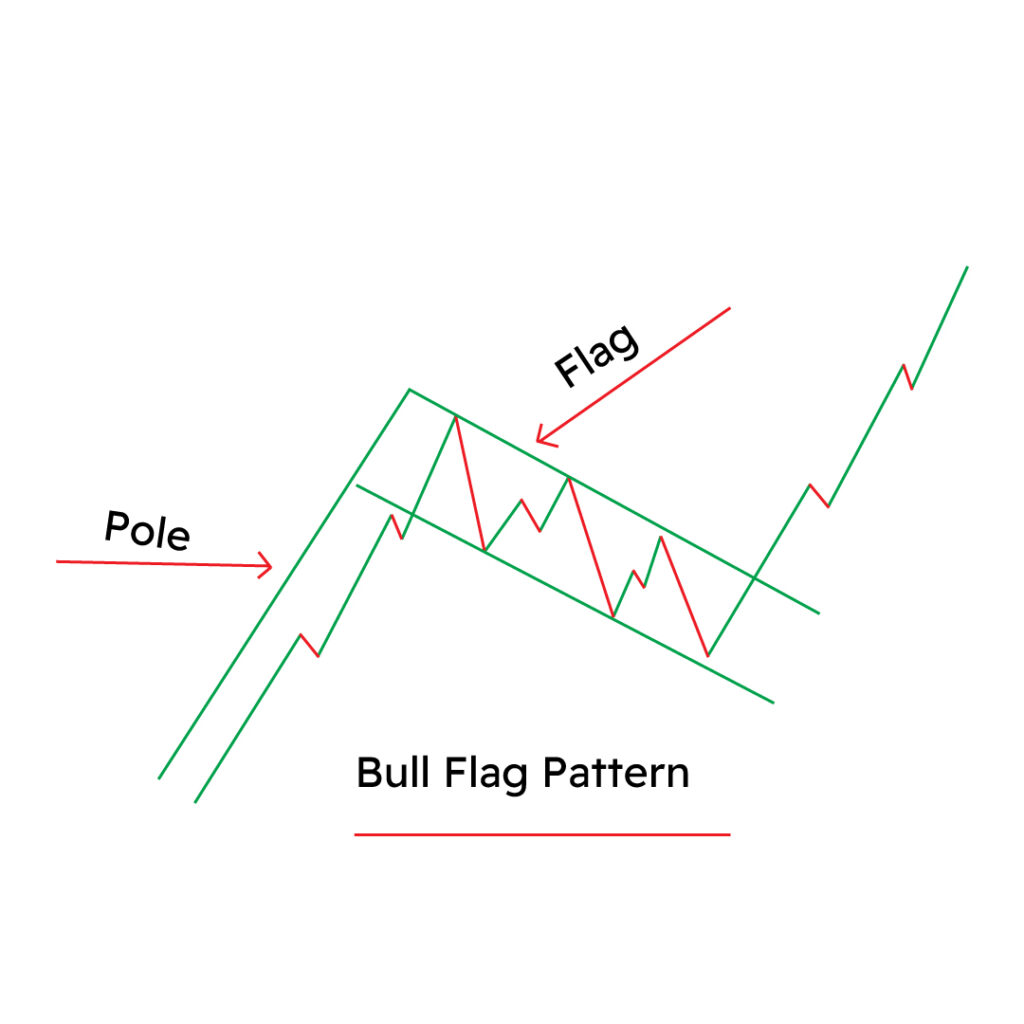

Bull (Bullish) Flag Pattern

A Bull or Bullish flag pattern formed after a strong upward price movement (flagpole), there is a period of consolidation where the price trades within a channel sloping downwards. This creates a rectangular-shaped flag.

- Identify a clear uptrend followed by a sharp upward move (flagpole).

- Look for a period of consolidation within a defined trading range (flag).

- Place a buy order above the upper trendline of the flag.

- Set a stop-loss order below the lower trendline of the flag.

- Monitor the price action and close the position if the trend breaks down.

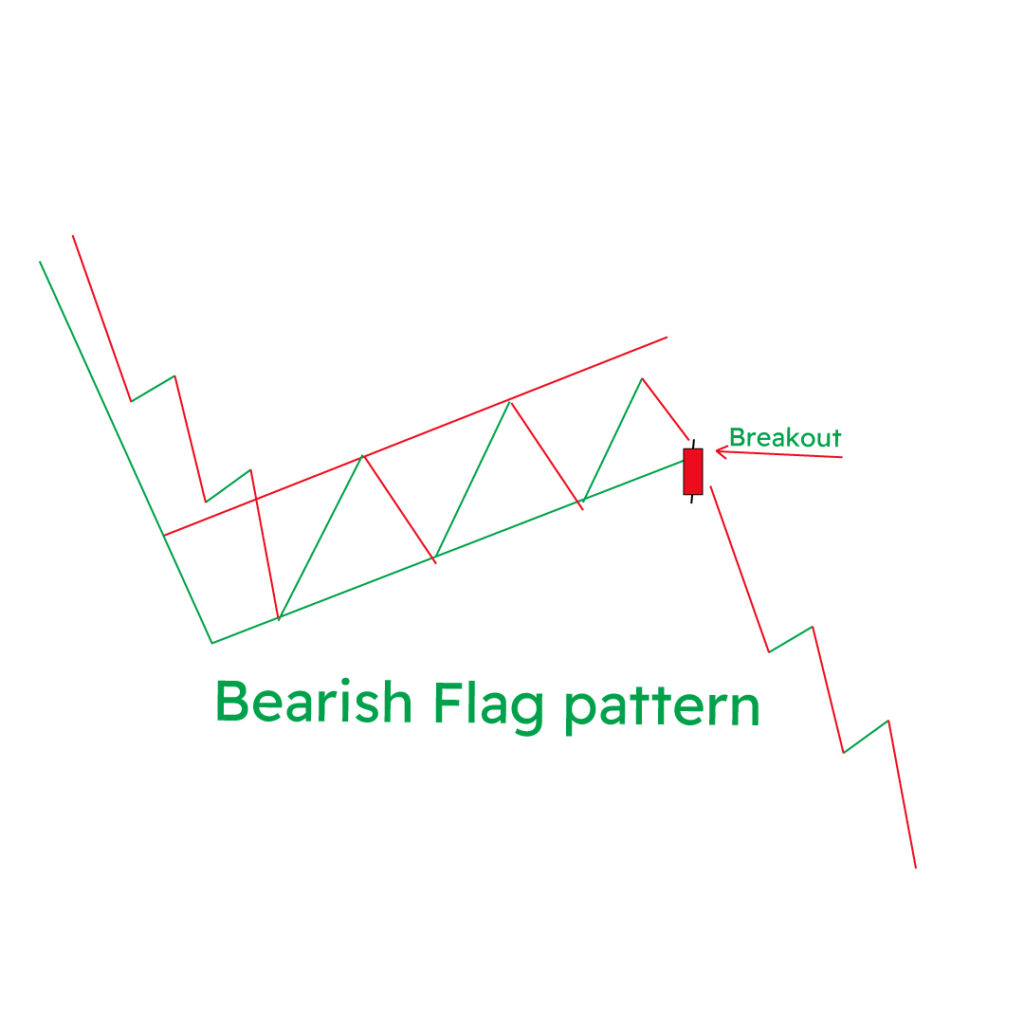

BearFlag Pattern

A Bear or Bearish Flag Pattern in Stock, Forex and Crypto market indicate the continuation of downtrend.

Following a notable downward price movement (flagpole), there’s a consolidation phase where the price moves within a channel sloping upwards, forming a flag-like pattern.

- Identify a clear downtrend followed by a sharp downward move (flagpole).

- Look for a period of consolidation within a defined trading range (flag).

- Place a sell order below the lower trendline of the flag.

- Set a stop-loss order above the upper trendline of the flag.

- Monitor the price action and close the position if the trend reverses.

Flag Pattern Trading Strategy

The Flag Pattern Breakout Trading Strategy involves the following steps:

Identifying the Flag Pattern:

- Trend: Identify a clear uptrend (for a bull flag) or downtrend (for a bear flag) in the price chart.

- Flagpole: Look for a sharp and sustained move in the direction of the trend, forming the flagpole.

- Flag: Identify a period of consolidation following the flagpole, with prices trading within a defined range. This range forms the “flag” of the pattern.

- Confirmation: Wait for the price to break out of the flag, either above the upper trendline (bull flag) or below the lower trendline (bear flag).

- Entry Point: Place a buy order above the upper trendline of the flag (bull flag) or a sell order below the lower trendline (bear flag) to enter the trade once the breakout is confirmed.

- Stop-Loss Order: Set a stop-loss order below the lower trendline for a long trade (bull flag) or above the upper trendline for a short trade (bear flag). This helps limit potential losses if the breakout fails.

FAQS

What is the flag pattern indication?

Flag patterns in trading indicate potential continuations of the current price trend in the market.

When traders spot a flag pattern, it suggests that after a significant price movement (the flagpole), the price takes a breather, consolidating in a flag-like formation before potentially resuming its prior direction.

How do you read a flag pattern?

Identify the trend – bullish or bearish.

Look for a flag-shaped consolidation after a strong price move.

Confirm well-defined boundaries within the flag.

Monitor decreasing volume during the flag formation.

Anticipate a breakout above or below the flag’s boundaries.

Confirm breakout with increased volume.

- Dark Cloud Cover: A Guide to Trading This Bearish Candlestick Pattern - 26 December 2023

- Title: Piercing the Veil of Market Sentiment: The Piercing Pattern in Trading - 26 December 2023

- Bullish Marubozu: A Comprehensive Guide to Trading with Confidence - 26 December 2023