In the world of stock trading, the ability to read and interpret candlestick patterns is a crucial skill. Among these, the Morning Star pattern stands out as a beacon of potential bullish reversal. This blog post delves into what the Morning Star pattern is, where you can find it, how to trade it, and strategies to consider when you encounter this formation.

What is the Morning Star Candlestick Pattern?

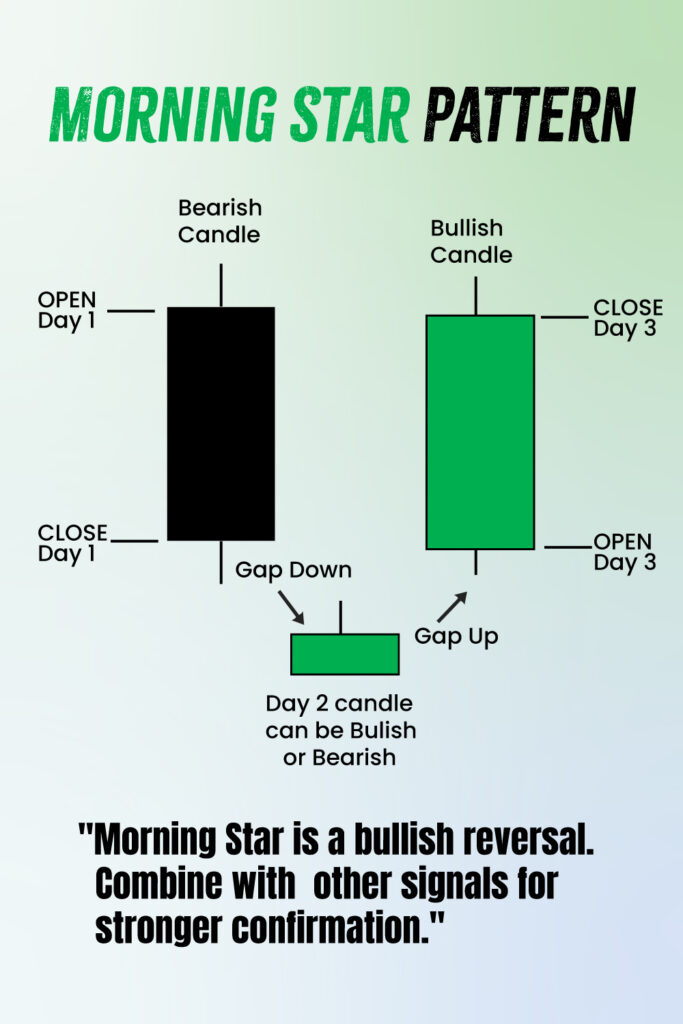

The Morning Star is a bullish candlestick pattern typically found at the bottom of a downtrend. It’s a sign that the bearish trend may be weakening, and a bullish reversal is on the horizon. The pattern is comprised of three candles:

- The first candle is a long bearish one, reflecting the ongoing downtrend.

- The second candle opens lower, suggesting continued bearish sentiment, but closes the day with a small range, indicating indecision.

- The third candle is a long bullish one, signifying a shift in market sentiment from bearish to bullish.

This pattern gets its name because, like a morning star heralding the dawn, it suggests that brighter times (i.e., a bullish trend) are coming after a period of darkness (the downtrend).

Where to Find the Morning Star Pattern

Identifying the Morning Star pattern requires a keen eye on candlestick charts. Look for this pattern in the following contexts:

- At the end of a pronounced downtrend.

- In areas of historical support.

- When indicators like RSI show that the stock is oversold.

The reliability of the Morning Star pattern increases in these scenarios, especially if it’s accompanied by high trading volume on the third day.

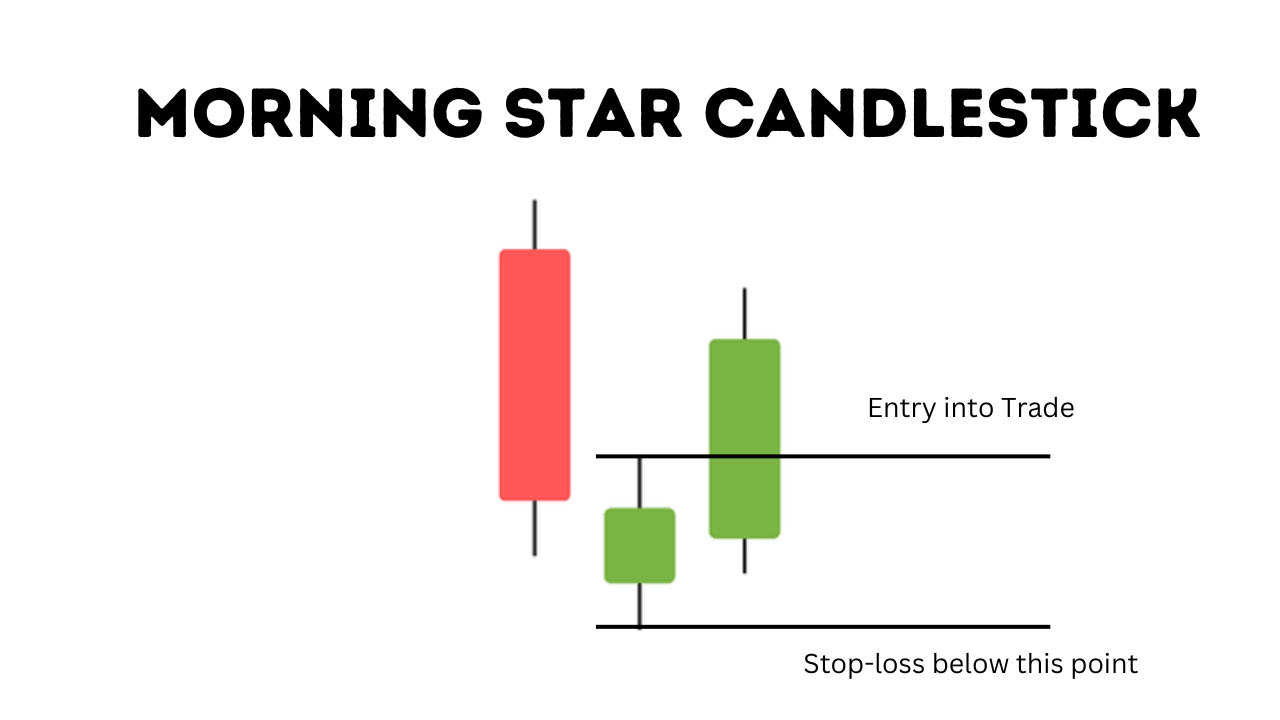

How to Trade the Morning Star Pattern

When you spot a Morning Star, it’s a signal to consider bullish positions. However, here are some tips to refine your approach:

- Confirmation: Wait for additional confirmation after the pattern forms. This could be the next candle closing above the third candle or other technical indicators aligning.

- Volume Analysis: An increase in volume on the third day of the pattern provides additional confirmation.

- Stop Loss Orders: Place stop-loss orders below the lowest point of the Morning Star to limit potential losses.

Trading Strategy Using the Morning Star Pattern

Here’s a simple strategy to capitalize on the Morning Star pattern:

- Confirmation: Enter a long position after the pattern is confirmed by a subsequent bullish candle or other technical indicators.

- Profit Target: Set a profit target based on previous resistance levels or use a risk-reward ratio of at least 2:1.

- Risk Management: Always have a stop-loss order to manage the risk. A common approach is to set the stop loss just below the lowest point of the Morning Star pattern.

Conclusion

The Morning Star candlestick pattern is a powerful tool in a trader’s arsenal, signaling a potential shift from bearish to bullish trends. Remember, while it’s a strong indicator, no pattern guarantees success. Always combine it with other technical analysis tools and sound risk management practices to enhance your trading strategy.

Whether you’re a seasoned trader or just starting, understanding and utilizing patterns like the Morning Star can be a significant step towards making informed trading decisions. Happy trading!

- Dark Cloud Cover: A Guide to Trading This Bearish Candlestick Pattern - 26 December 2023

- Title: Piercing the Veil of Market Sentiment: The Piercing Pattern in Trading - 26 December 2023

- Bullish Marubozu: A Comprehensive Guide to Trading with Confidence - 26 December 2023