Navigating the world of trading often involves decoding various candlestick patterns to predict future market movements. One such pattern, known for its potential to signal a bullish reversal, is the Piercing Pattern.

This blog post aims to provide a comprehensive understanding of the Piercing Pattern, its significance in trading, and how it can be a valuable tool in a trader’s arsenal.

Understanding the Piercing Candlestick Pattern

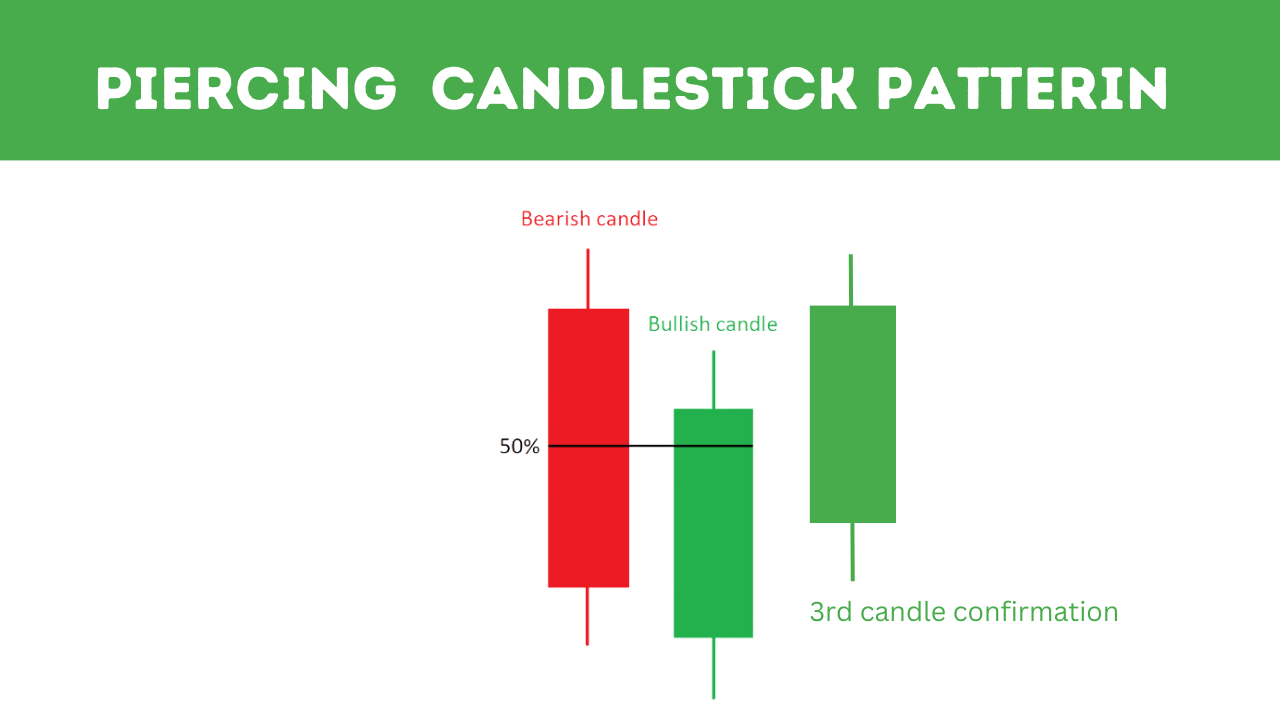

The Piercing Pattern is a two-candlestick formation typically found at the end of a downtrend and is considered a potential indicator of a changing market sentiment from bearish to bullish. It comprises two key components:

- The First Candle: This is a bearish candle, signifying the continuation of the downtrend.

- The Second Candle: This is a bullish candle. The critical feature of this candle is that it opens lower than the close of the previous bearish candle, but closes above the midpoint of the body of the first candle.

Characteristics of the Piercing Pattern

- Appearance in a Downtrend: For the pattern to be valid, it must occur during a pronounced downtrend.

- Bullish Reversal Signal: The second day’s strong close suggests a shift in momentum from sellers to buyers.

- Volume: An increase in volume during the formation of this pattern can add credibility to the potential reversal.

Trading Strategy with the Piercing Pattern

Identifying the Pattern:

- Look for a strong downtrend.

- The first candle should be a long bearish one.

- The second candle must open below the first one’s close and close above the midpoint of the first candle’s body.

Entry Points:

- Consider entering a long position if the pattern is confirmed, typically after the close of the second candle.

- Additional confirmation from indicators like RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence) can strengthen the trade setup.

Exit Points and Stop-Loss:

- Set a stop-loss below the lowest point of the Piercing Pattern to mitigate risk.

- Target an exit point considering the next resistance levels or using a risk-reward ratio that aligns with your trading strategy.

Risk Management:

- Ensure that the Piercing Pattern aligns with your overall trading plan and risk tolerance.

- Diversify your trades and avoid basing decisions on this pattern alone.

Contextual Importance of the Piercing Pattern

The Piercing Pattern doesn’t operate in isolation. Its effectiveness is influenced by the market context, including the strength of the downtrend, market news, and broader economic indicators. Combining the pattern with other technical analysis tools provides a more robust trading strategy.

The Piercing Pattern offers traders a window of opportunity to capture potential bullish reversals. However, it’s crucial to approach this pattern with a balanced perspective, considering both the market context and complementary technical indicators

What is the opposite of a piercing pattern?

The Dar Cloud Cover Candlestick pattern is the opposite the piercing pattern. You can Learn more about Dark Cloud Cover Candle Pattern here

- Dark Cloud Cover: A Guide to Trading This Bearish Candlestick Pattern - 26 December 2023

- Title: Piercing the Veil of Market Sentiment: The Piercing Pattern in Trading - 26 December 2023

- Bullish Marubozu: A Comprehensive Guide to Trading with Confidence - 26 December 2023