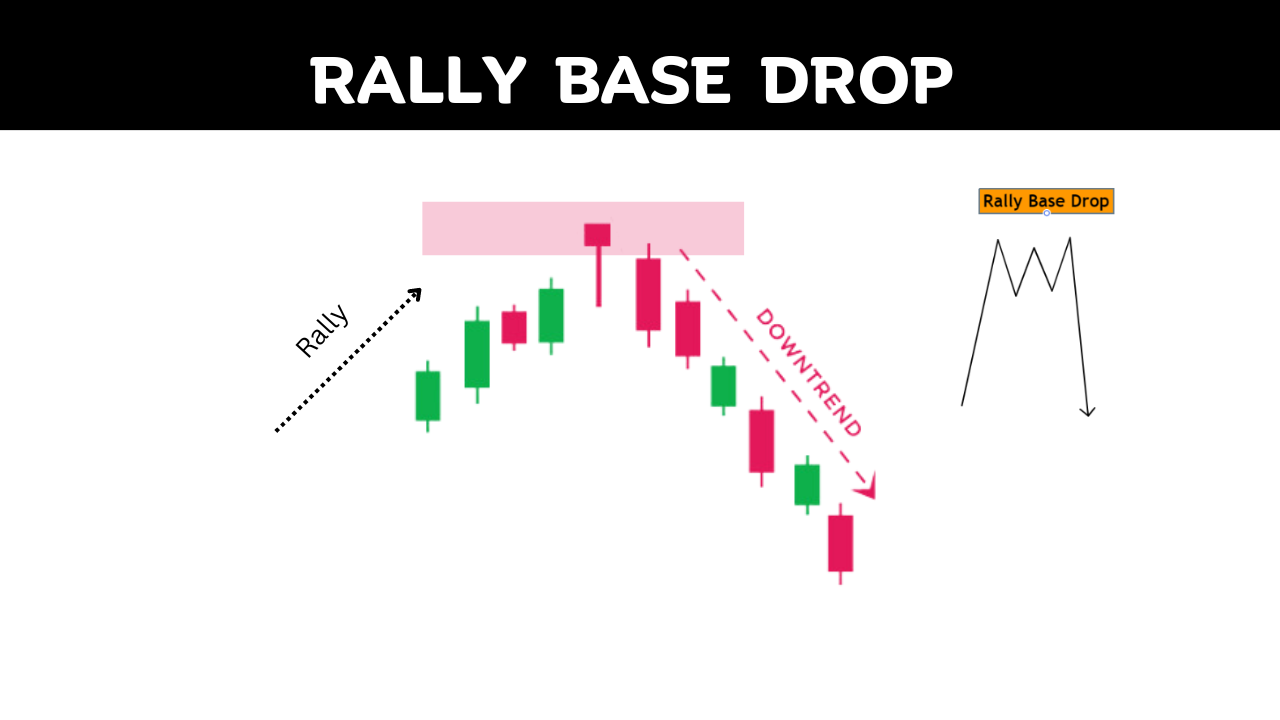

A rally base drop (RBD) is a supply and demand price pattern in financial markets that indicates a potential reversal of a downtrend. It is characterized by three phases:

- Rally: The price makes a strong upward move, suggesting that the bulls are in control.

- Base: The price consolidates or trades sideways, forming a temporary support level. This consolidation indicates that the bulls are taking a breather and that the bears are attempting to regain control.

- Drop: The price breaks down through the support level, signaling that the bears have regained control and that the downtrend is likely to resume.

RBDs are often seen as a bearish reversal pattern, as they suggest that the bulls are losing momentum and that the bears are taking over. However, they can also be seen as a continuation pattern, if the price breaks down through the support level and continues to fall.

Understanding Rally Base Drop(RBD) Pattern

Imagine you’re playing a tug-of-war game between two teams: the bulls (buyers) and the bears (sellers). The price of a stock or other financial instrument is like the rope in the game.

In a rally base drop pattern, the bulls are initially pulling the rope strongly, causing the price to rise (rally). Then, the bulls get tired and start to let go of the rope, causing the price to consolidate or trade sideways (base). Finally, the bears see their opportunity and start pulling the rope hard, causing the price to drop (drop).

This pattern suggests that the bulls are losing momentum and that the bears are taking over. Traders use this pattern to identify potential selling opportunities, as they expect the price to continue to fall after it breaks down through the support level.

Rally Base Drop Trading Strategy

- Enter Short Position: Once the price breaks down through the support level, initiate a short position, anticipating further price declines. You can Enter the Short Position on the Base of the Fair Value Gap, Order Block.

- Set Stop-Loss Order: Place a stop-loss order above the support level to limit potential losses in case of an unexpected price reversal.

- Monitor Price Action: Continuously monitor price action to assess the strength of the downtrend and adjust the stop-loss order accordingly.

- Exit Short Position: Once the downtrend appears to be exhausted or a significant reversal signal emerges, close out the short position to lock in profits.

- The chart below shows that your next target is sell-side liquidity

Learn more about

- What is Supply and Demand Trading

- what is Rally Base Rally

- What is Drop Base Drop (DBD) Pattern

- What is Drop Base Rally

- Dark Cloud Cover: A Guide to Trading This Bearish Candlestick Pattern - 26 December 2023

- Title: Piercing the Veil of Market Sentiment: The Piercing Pattern in Trading - 26 December 2023

- Bullish Marubozu: A Comprehensive Guide to Trading with Confidence - 26 December 2023