The three-drive pattern is a rare but powerful reversal pattern used in technical analysis to predict an upcoming change in a trend.

It consists of three consecutive drives (or legs) in the direction of the new trend, with each drive being smaller than the previous one. The drives are separated by retracements, which are pullbacks towards the old trend.

- Three drives: The pattern is formed by three consecutive drives in the direction of the new trend. These drives can be either higher highs (in an uptrend) or lower lows (in a downtrend).

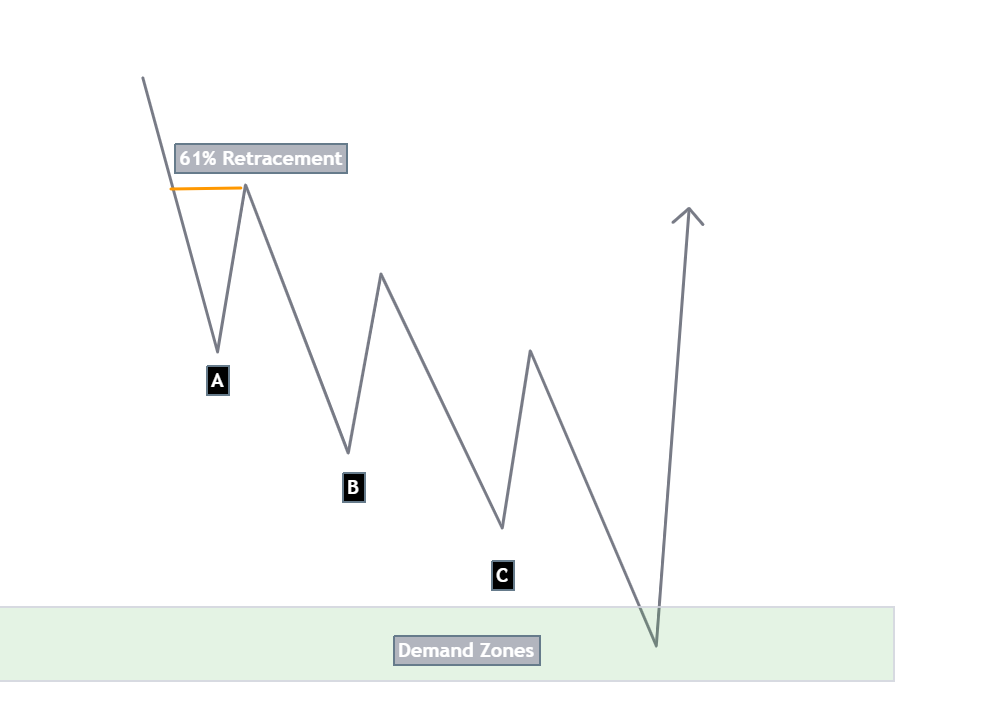

- Retracements: Each drive is followed by a retracement, which is a pullback towards the old trend. The retracements should not exceed 61.8% of the previous drive.

- Fibonacci extensions: The price often reaches a Fibonacci extension level, such as 127.2% or 161.8%, at the end of the third drive.

What is the 3-Drive pattern?

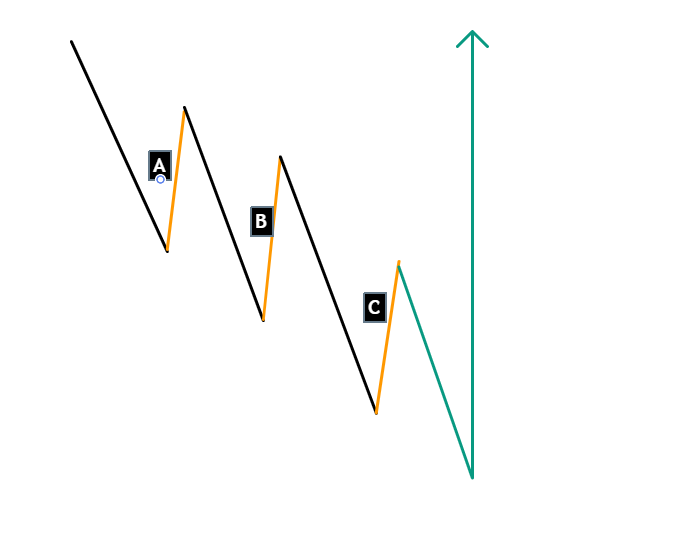

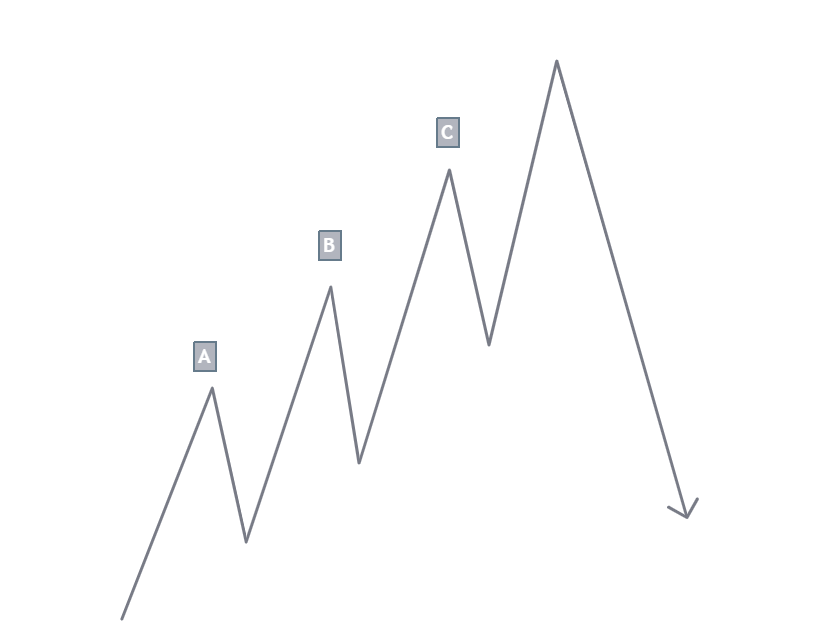

- First Drive (AB): The pattern begins with an initial price move (AB), which could be an uptrend or a downtrend.

- Correction (BC): After the first drive, there is a retracement or correction (BC) in the opposite direction of the initial move. This correction typically retraces a significant portion of the initial drive.

- Second Drive (CD): Following the correction, there is a second price move (CD) that mirrors the direction of the first drive. This second drive is expected to have a similar or equal length to the first drive.

- Correction (DE): Similar to the first correction, there is another retracement or correction (DE) after the second drive.

- Third Drive (EF): The pattern concludes with a third and final drive (EF), again moving in the direction of the initial drive. The third drive is expected to be similar or equal in length to the first and second drives.

Bullish 3 Drives Pattern

The Bullish Three Drives pattern is a specific variation of the Three Drives pattern that suggests a potential bullish reversal in the market. It’s a harmonic pattern that consists of three consecutive drives lower, each followed by a correction, and then a final drive higher.

The pattern is characterized by symmetry between the drives and corrections.

Bearish 3 Drives pattern

The Bearish Three Drives pattern is another variation of the Three Drives pattern, signaling a potential reversal to the downside in the market. Similar to the bullish version, it consists of three consecutive drives higher, each followed by a correction, and then a final drive lower.

Trading Strategy 3-drives pattern

Identifying the Pattern:

- Trend: Look for the pattern in a well-established trend (uptrend for bullish, downtrend for bearish).

- Drives and Retracements: Identify three consecutive drives (higher highs/lower lows) with retracements (pullbacks) between each.

- Retracement Depth: Ideally, retracements should not exceed 61.8% of the previous drive.

- Confirmation: Use other technical indicators like MACD, RSI, or Stochastic Oscillator to confirm the trend direction and momentum.

- Fibonacci Levels: Look for potential price targets at Fibonacci extension levels like 127.2% or 161.8%.

Entry and Exit:

- Entry:

- Conservative: Enter after the price breaks above/below the high/low of drive 3, confirming the breakout.

- Moderate: Enter at the 127.2% Fibonacci extension of drive 3.

- Aggressive: Enter at the 61.8% retracement of drive 3.

- Stop-Loss:

- Place a stop-loss below the swing low of each drive (bullish) or above the swing high (bearish).

- Consider trailing stops to lock in profits.

- Take-Profit:

- Target the 161.8% Fibonacci extension of drive 3.

- Look for natural resistance/support levels or overbought/oversold RSI readings to exit.

- Manage your risk-reward ratio, aiming for profits exceeding potential losses.

- Dark Cloud Cover: A Guide to Trading This Bearish Candlestick Pattern - 26 December 2023

- Title: Piercing the Veil of Market Sentiment: The Piercing Pattern in Trading - 26 December 2023

- Bullish Marubozu: A Comprehensive Guide to Trading with Confidence - 26 December 2023